Vietnam economic impact of COVID in 2020

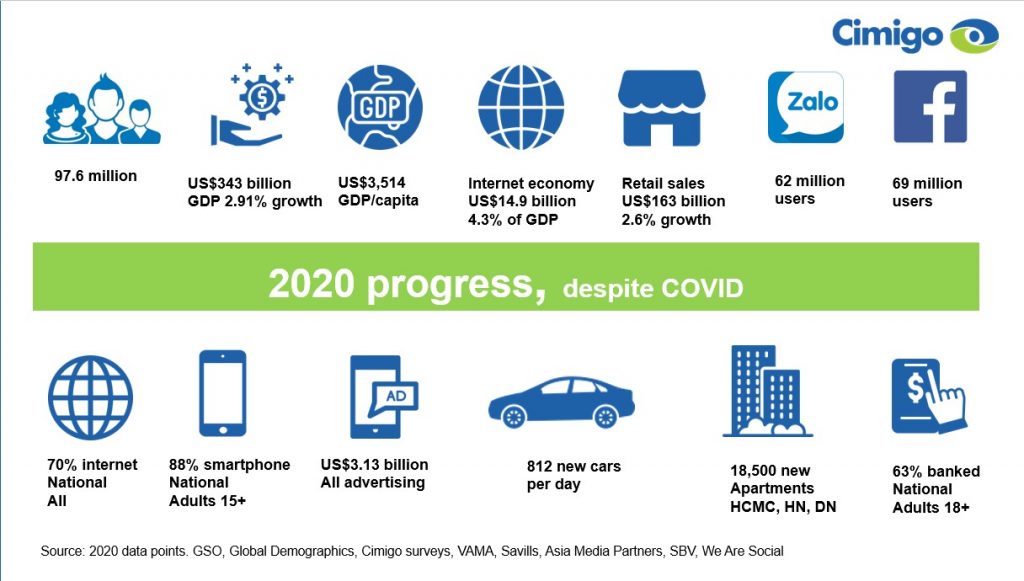

Vietnam had a stellar performance in 2020 even in the face of Covid adversity. Vietnam has experienced economic growth rates in the region of 5 to 7% over the last 10 years. 2020 was a tumultuous year with Covid prevention methods placed what is in hindsight, a bump in economic activity and consumer confidence. Despite the global and local implications of Covid, economic progress has been the envy of most nations.

Vietnam’s 2020 bounce back

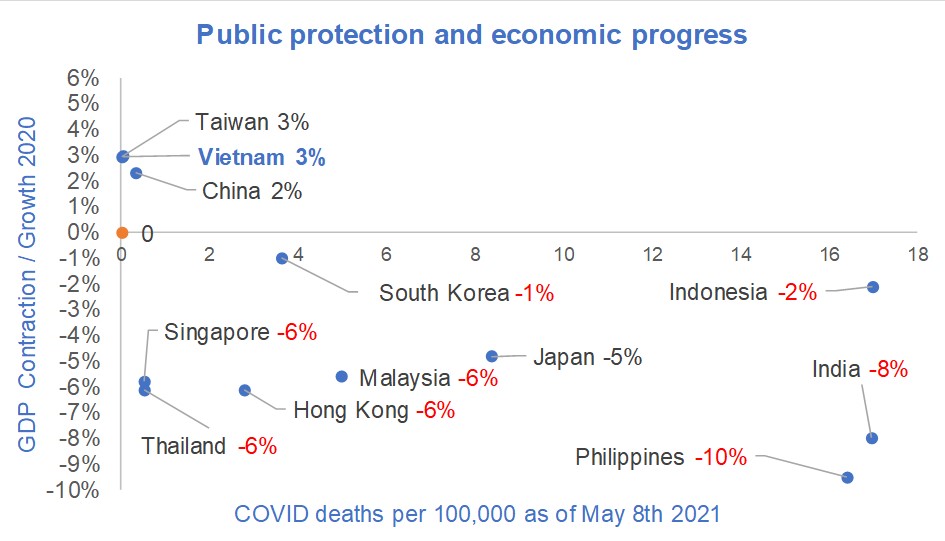

The dual policy of protecting public health and safeguarding the economy has been extremely effective. The GDP growth rate for the year reached 2.91% in Vietnam, across South East and East Asia Vietnam only Taiwan reached a higher growth rate at 2.98%.

Covid public protection versus 2020 economic progress

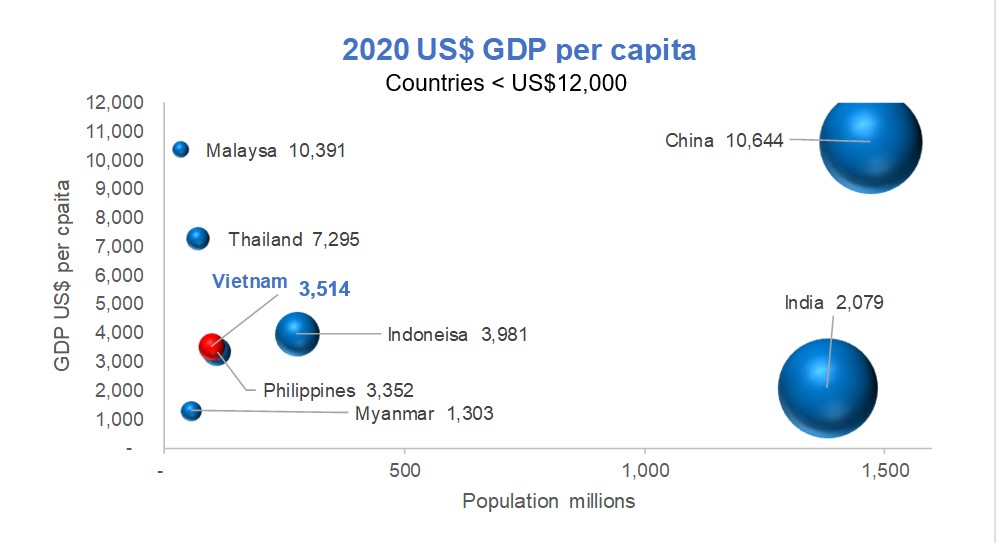

Vietnam now the 4th largest economy in SE Asia

Vietnam’s absolute GDP reached US$343 billion in 2020, surpassing both Singapore and Malaysia and placing Vietnam as the 4th largest economy in South-East Asia, behind Indonesia, Thailand and the Philippines.

Amongst developing Asian markets Vietnam has a per capita income of US$3,514 above the Philippines and behind Indonesia. Evidence of economic activity in quarter 1, 2021 demonstrates the bounce-back that Vietnam’s economy has achieved.

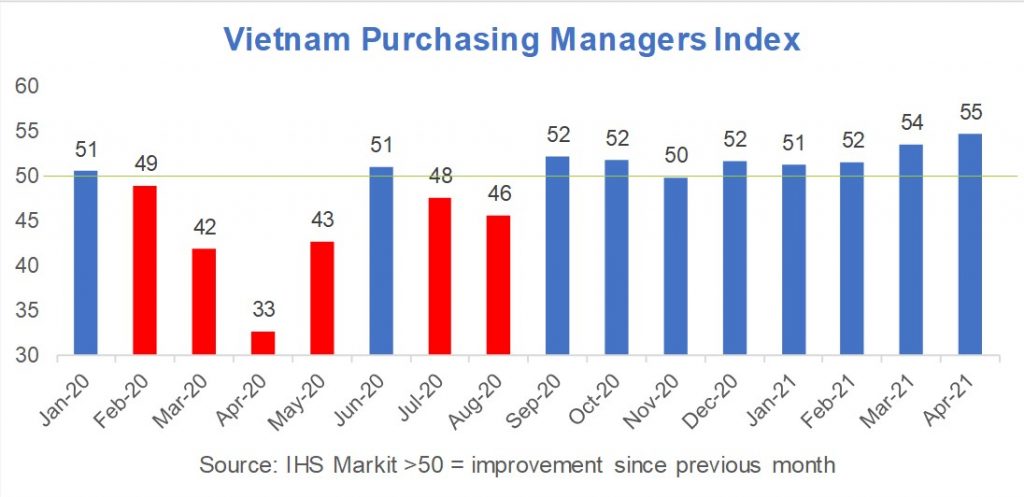

Vietnam’s economic performance in quarter 1, 2021

Vietnam’s manufacturing contributes near ¼ of GDP and has bounced back

Evidence from the IHS Markit’s purchasing managers index (measured by Cimigo in Vietnam) demonstrates how strongly manufacturing has bounced back. Manufacturing accounts for nearly 25% of GDP and has a significant impact on adding jobs.

Exports have performed extremely strongly over quarter 4 2020 and the rise continues in quarter 1 2021. Vietnam has a plethora of trading agreements globally and is currently the most inter-connected trading nation globally with an index of 159%.

- Interconnected global trade is defined as imports plus exports expressed as a % of GDP. This is down from 200% in 2019, as previous GDP calculations were re-calibrated increasing GDP by over 20%.

Vietnam Consumer Trends and the impact of Covid in 2020

Covid has proved that attitudinal changes do not necessarily need to precede behavioural change. Covid has nudged along numerous behavioural changes with limited impact on attitudes. That said, there are two key attitudinal shifts that stand out.

- Vietnam had a strong national pride before Covid. Consumers aspire for their cities to become like Singapore and have great pride in the strides the economy and society has made in moving forward. Most visibly the streets come alive during national football games with whole families taking to the streets to celebrate wins and enjoy the comradery that envelops the national mood. It is also apparent in successful marketing campaigns that have propelled local brands from Vinamilk to Bitis. National pride has been raised further by the management of Covid and the protection of the public’s wellbeing.

- Concerns towards hygiene and health have naturally been heightened. This has moved beyond avoiding community infection and impacted personal hygiene, diets, nutrition, immunity-boosting supplements, stress management and exercise regimes. Lockdowns bought a pause and moments of reflection that have seen changing attitudes to lifestyles. There is a greater propensity for healthy marketing propositions and exercise regimes beyond gyms, such as; the exponential rise in yoga, running and cycling.

Download Vietnam Consumer Trends

Vietnam household income falls 12% across 2020

Behavioural changes varied vastly depending on Covid’s impact on the household’s income. Household incomes dropped by 12% in 2020. Household income shortfalls on average equate to one month’s salary. Yet the averages mask those households which were far harder hit.

Provinces with a high concentration of tourism and manufacturing were hardest hit, with both job losses and a loss of overtime. In 2020 1,630,000 people lost their jobs, job losses continued into quarter 1 2021 for a further 181,000. Tourism, hospitality, small trading owners and blue-collar production employees were the hardest hit. Vietnam has a large migrant workforce who return to their home provinces when things get tough. The agricultural economy acts as a sponge to this workforce, where they have shelter, can eat, but are grossly underemployed.

Working adults in Vietnam have on average have 1.67 sources of income. For so many secondary income sources of income were hit hard; typically small stores and trading enterprises.

Those households hardest hit were typically lower-income households classified as E and F class, where the main income earners are over 40. Those in the largest cities found more alternatives. Younger employees were more agile. White-collar employees proved more agile and their jobs were more secure.

90% of households will recover to 2019 income levels in quarter 3 of 2021. In the meantime, the household savings rate has declined but will recover in quarter 4 of 2021. By quarter 4 of 2022 household saving nests will have recovered in full.

Vietnam consumer trends and the impact on buying behaviour of COVID in 2020

Consumer packaged goods (CPG) in Vietnam largely grew in 2020, albeit at a slower pace than 2019. Vietnam household income shortfalls derailed the historic premiumisation trends of consumer-packaged goods as consumers sought value for money propositions to reduce stress on their household budgets. Down trading in consumer-packaged goods will continue through 2021.

Planned high ticket purchases were delayed. Vehicles and appliances are expected to recover in quarter 4 2021. All discretionary expenditure was re-evaluated. Travel was restricted and plans remain cautious and closer to home. Out of home entertainment expenditure was held back. It has since rebounded although localised periodic Covid scares create high volatility for all discretionary expenditure. Super-premium luxury consumer packaged goods (CPG) and durable goods did not decline in Vietnam, as very wealthy households continued their expenditure.

Download Vietnam Consumer Trends

Which categories experienced Vietnamese consumer demand shrink in 2020?

The categories depicted below saw a contraction of sales in 2020. The decline being more marked for those to the left of the chart below. Outbound travel, out of home entertainment, domestic travel, eating out of home, spa and beauty services all saw declines in demand.

High ticket vehicles and durables suffered as purchases were delayed. New apartment sales were further constrained by supply issues dropping from 88,000 in 2019 to 18,500 in 2020 (both numbers being across HCMC, Hanoi and Danang only).

Vietnam car sales (excluding imports which are mostly luxury) declined by 8% over 2019 to nearly 297,000 in 2020. Vietnam motorbike sales dropped 17% over 2019 to just over 2.7 million two-wheelers in 2020.

Vietnamese demand which shrank in 2020

Home appliances, fashion (sports apparel being an exception), devices including smartphones and tablets and home furnishing sales in Vietnam all declined in 2020. It is worth noting that Covid’s stay at home demands overseas have driven demand for furniture in export markets, demand grew exponentially over 2020, to the benefit of Vietnam’s export growth.

Vietnam pent-up demand during Covid

These changes do not represent permanent changes, as pent-up demand remains, these categories will bounce back as household incomes recover and (hopefully) community transmissions of Covid dissipate.

Which categories saw Vietnamese consumer demand accelerate in 2020?

In contrast, the categories and channels depicted below saw their historic growth accelerate (often dramatically) in 2020. The growth is more marked for those to the left of the chart below.

Those categories and channels above the arrow will see their growth endure, spurred forward by Covid and fundamentally altering how consumers in Vietnam behave. These changes in behaviour will not reverse as Covid dissipates. Those categories below the arrow are shifts in consumer expenditure that will not endure, as they are reactionary behavioural changes brought about by Covid.

Vietnamese demand which accelerated in 2020

Consumer behavioural changes which will endure beyond Covid

Online shopping has expanded penetration, transaction volumes and “basket’ size over 2020, propelling a massive 54% increase in e-commerce sales in Vietnam in 2020. This will endure, it has helped the channel build both familiarity and trust with consumers.

Consumer packaged goods (CPG) have experienced significant down trading, as consumers have been thrifty with their expenditure. Even as household incomes rebound, shifting the choices to more premium offers will take time. Many will have found themselves satisfied with their new choices and CPG manufacturers will take time to build momentum in their marketing, in order to encourage up trading to more premium offers.

Download Vietnam Consumer Trends

Delivery and ride-sharing have been accelerated not just by working from home but also by the propensity to avoid contact with stores and food and beverage outlets. This along with the stratospheric rise in e-commerce has further propelled delivery and ride-sharing services on both the demand side and also the expansion of existing players and the entry of new players.

Both online gaming and content streaming through the likes of YouTube, TikTok and Qiy have accelerated as consumers have spent less time out of home and more time on their smartphones.

E-wallets have benefited as the use of cash on delivery diminishes slightly to the benefit of mobile payments. Online education platforms, whilst nascent, have been given a helping push to penetrate consumer homes.

Consumer behavioural changes which are reactionary will reverse to pre-Covid levels

Numerous fast-moving consumer products relating to hygiene and preventing transmission have experienced strong growth over 2020. These include hand sanitiser, masks, even regular bar and liquid soap, body wash and following rumours of Covid festering in our throats, mouthwash.

The following categories have seen a tremendous upside as a result of Covid in 2020.

- Food and beverage delivery.

- Hoarding of consumer-packaged foods in case of stay-at-home orders.

- Health supplements to maintain health and build stronger immunity.

- Books and stationery for home entertainment and schooling.

- Electrical accessories to enable better in-home streaming entertainment and gaming.

- Sports apparel to embrace healthier lifestyle choices.

As and when Covid dissipates these categories will reverse to their typical growth trajectories last seen in 2019.

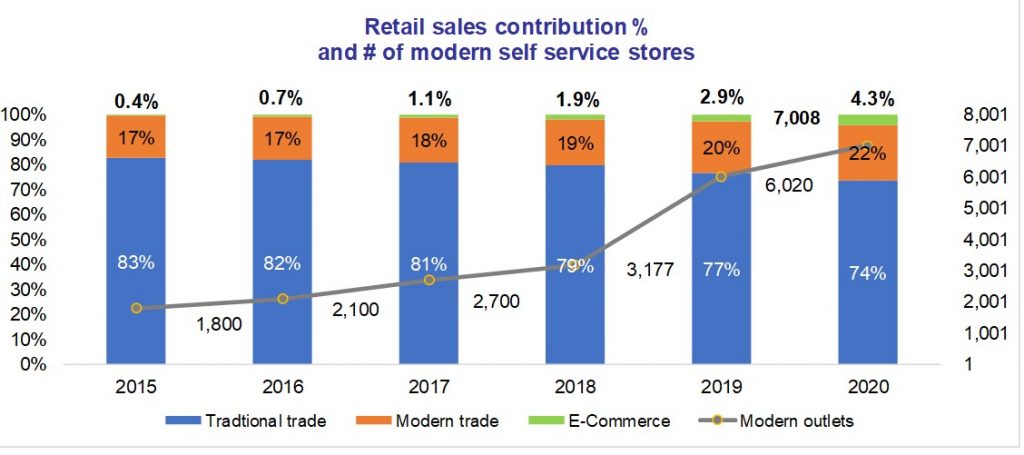

Retail sales and channel contributions continue to shift in 2020

Vietnam’s retails sales saw modest growth of 2.6% in 2020 (compared with 12% in 2019) as Vietnamese consumer demand was subdued. In quarter 1 2021 Vietnam’s retail sales have started to rebound with a growth rate of 5.1% (admittedly compared to quarter 1 2020).

Cimigo’s online shopping studies have shown that Vietnam’s e-commerce reached a tipping point in 2018 with a 60% penetration in key metropolitan cities, this has now reached 80% in 2020, largely propelled forward by Covid.

Vietnam’s retail channel sales contribution

The greatest contribution to retail sales has been the traditional (unorganised) trade consisting of wet markets and independent neighbourhood stores. In 2015 the traditional trade accounted for 83% of retail sales compared with 74% in 2020.

Modern trade’s contribution to retail sales grew from 17% in 2015 to 22% in 2020. Modern trade outlets have grown significantly since 2018 with a rise of modern formats; those with air conditioning, self-service and a check out cashier. There are now just over 7,000 such outlets, growing from a mere 1,800 in 2015.

The greatest growth in outlets has been from Bach Hoa Xuan, with a mini-market format combining a large array of fresh products and consumer packaged goods. Bach Hoa Xuan has expanded rapidly in southern Vietnam and is now moving both further north and beyond the largest cities into provincial and rural domains.

Vinmart+ has been a significant contributor to the growth of outlets, despite post the sale to Masan, closing 700 poorer performing stores in 2020. Vinmart+ (soon to be known as Winmart) is still opening new stores and providing more distribution points which benefit the growth of their own consumer packed goods portfolio.

Download Vietnam Consumer Trends

E-commerce sales grew by 54% in 2020 providing a contribution of 4.3% to Vietnam’s retail sales in 2020. E-commerce logistics and delivery times are improving their service to rural areas exponentially. Online shopping is on track to surpass the modern trade share of sales in 2028.

Screen time: Marketing to Vietnamese consumers with algorithms

On average consumers are spending six hours and forty-seven minutes glued to their mobile screens. This is great news if you are an optician. Consumers spend over two hours on social media and chatting applications and nearly three hours watching streamed content for entrainment and perhaps a little education.

Immediacy is the new norm and for those in their 20s and 30s, these consumers are compelled by almost instant gratification and a shift of purchasing priorities to expenditure on experiences, whereas the prior generation sought ownership of possessions. Aspirations and ideals of success have been refined to recognition for enjoying new experiences (be that outdoor adventures or a new artesian café) which may be posted on social media.

The digital transformation of the consumer economy with new business models and the sharing economy has democratised access to goods and services previously only available to a limited segment. It is far easier to gain access to promotions, discounts and loans, making purchases more “affordable”. Vietnam’s consumer financing reached US$66 billion in 2020, growing 9% over the prior year and representing 41% of Vietnam’s retail sales.

In 2015 the digital economy was worth US$3 billion in Vietnam, in 2020 it reached nearly US$15 billion. Vietnam’s online shopping represented 47% of this, followed by advertising, gaming and media (22%), online travel booking (20%) and ride-hailing (11%).

Vietnam’s urbanisation and newest city; Thu Duc City

Vietnam introduced a new city in 2020, redrawing the limits of Ho Chi Minh City, districts two, nine and Thu Duc were reclassified into a new city; Thu Duc City. The population of Thu Duc City at 1,169,967 has created Vietnam’s third most populous city, behind HCMC (5,955,526) and Hanoi (3,962,310).

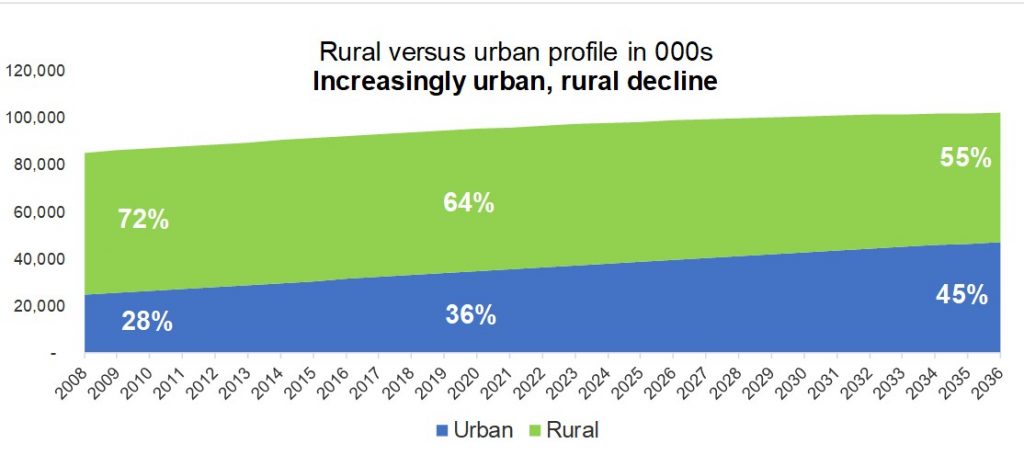

Vietnam’s rapid urbanisation drives efficiency and ultra-convenience

The urban population accounts for 36% of Vietnam’s 97,61,6610 strong population. By 2036 the urban population will reach 45%. Vietnam’s rural population commenced its decline in 2017, through increased urbanisation, urban migration and a rapid decline in birth rates. Rural household sizes fell from 4.6 in 2008 to 3.6 in 2020. Urbanisation provides for ongoing demand for ultra-convenience but a stressed infrastructure and increased pollution.

Vietnam’s demographic dividend

Vietnam has a diligent workforce propelled by women. 88% of women aged 20 to 64 work (as do 96% of men) and thereby contribute to economic development in Vietnam. Compared to other countries in Asia where far fewer women work (e.g. 21% in India, 46% in Thailand and 54% in Indonesia) the high proportion of women who work ensures a low dependency ratio. The dividend comes from the low number of dependents per working adult, which is just 0.7 in Vietnam.

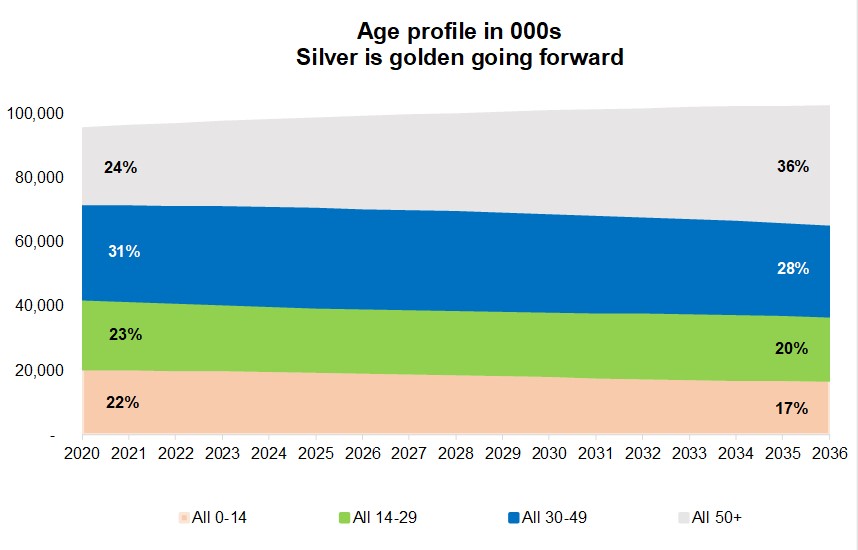

Elderly dependents will become a key challenge in the 2040s

Today 45% of Vietnam’s population are under 30 years of age, however, this will contract to 37% in 2036. The birth rate has declined from 75 in 2008 to 46 in 2020 (rate per 000 females 15 to 49). Children are the demographic segment that drives much of mums’ purchase behaviour.

Vietnam’s decelerating birth rates, under 14s and pester power

Visitors to Vietnam are always astounded by the smiles, dynamism and rapid changes in the city-scapes. Vietnam’s youth has historically provided for this amazing dynamism and energy.

However, the share of 0-14 years old’s is in rapid decline and the over 50-year-olds will become the most dominant population segment growing from 24% in 2020 to 36% in 2036. The staggering drop in the birth rate and an ageing population will take hold in the 2030s. Elderly dependents will become a key challenge in the 2040s.

Download Vietnam Consumer Trends

Vietnam’s dynamism leapfrogs the development path of more developed economies

The Vietnamese willingness to adopt new technology and an ensuing energetic dynamism has enabled Vietnam to leapfrog the development pathways followed by more developed economies. Examples include the jump from home telephones to smartphones, the jump from traditional trade channels to online shopping, the jump from terrestrial television to content streaming and the jump from car ownership to ride-hailing.

The jump to mobile banking saw mobile payments leapfrog credit cards. USD210 billion was transacted using mobile banking versus US$17 billion using credit cards in the first half of 2020.

Vietnam tops SE Asia clean energy output. In March 2021, VinFast launched its first electric car, the VFe34. From social selling to e-sports and from education to medical applications Vietnam provides businesses with opportunities to rapidly change the market landscape.

The impact of Covid on Vietnam’s economic progress and consumer dynamism

During the next decade in Vietnam, consumer dynamism and economic growth will continue unabated. The pace of positive economic progress and consumer dynamism will only quicken and outpace other developing markets. The opportunities this unleashes for investors and entrepreneurs will be phenomenal.

Drop me a note at ask@cimigo.com to learn more.