Vietnam mother care and baby care market

Sep 17, 2025

Vietnam mother care and baby are shaped by the convergence of modern science, deep cultural

Vietnam online shopping hits 60% penetration

20 minute read.

Online shopping in Vietnam has boomed in the past 12 months, with 60% of consumers shopping online in HCMC and Hanoi. The profile of online shopping is growing at an exceptional rate as increasingly sophisticated digital platforms and devices become widely accessible and an integral part of daily life.

Spend even just a few hours in Vietnam’s bigger towns and cities and you’ll soon see how the country has embraced consumerism in recent years. Mobile phone shops, fashion chains and multi-level international-standard shopping malls point to an economy that is ever more in tune with the retail sector. But is everything as it seems?

The market research results in Cimigo’s recent report Cimigo on Vietnam online shopping unearths details that many people will find surprising.

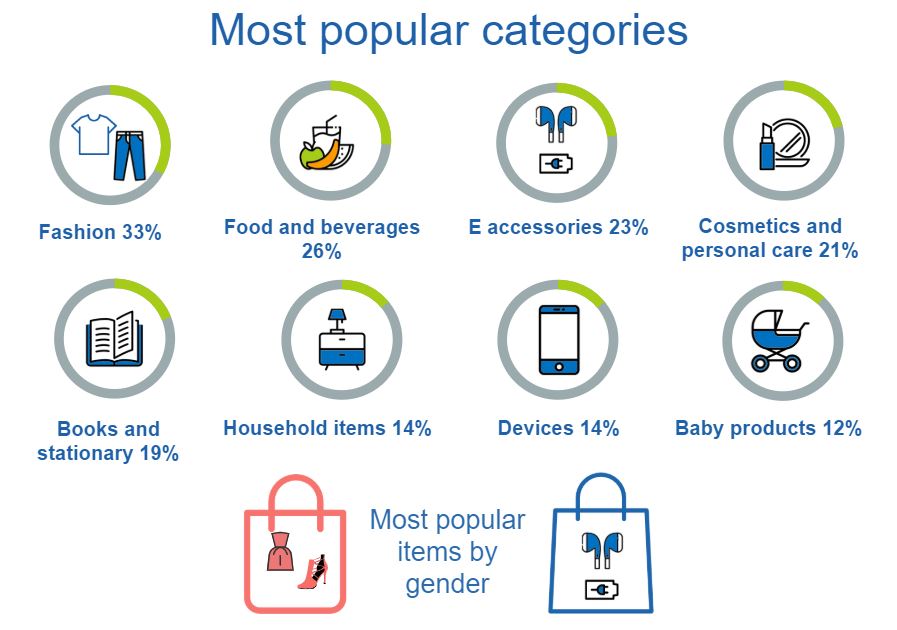

The early years of Vietnam’s e-commerce market has been dominated by food and beverage services with online food ordering quickly becoming a popular lifestyle choice for Vietnam’s young professionals. Now, however, there’s really nothing that can’t be purchased online and Vietnam’s online shoppers are taking full advantage of the choice available to them.

Whether it’s household and personal items such as furniture, clothing, cosmetics, gadgets or electronics – even lifestyle items such as event tickets, beauty services and online learning and study – shoppers of all ages are not just buying more things online but are doing so more often.

Purchase your Vietnam online shopping report here

Food and beverage purchases are still by far the most common online purchase, being made by shoppers every three days on average. This represents a huge cultural shift in Vietnam’s eating and dining habits. In fact, taking all online food and beverage items into account the figure rises to almost 20 purchases a month. This is remarkable considering that food delivery companies only started to get traction in Vietnam around five years ago, when there was very little scope for online ordering of general food and drink items.

So clearly we’re well past the novelty stage of ecommerce, where customers might nervously click their mouse to place an order and hope the item arrives. On the back of the familiarity and security of ordering food online several times a month, consumers now have confidence and trust in the wider shopping services available to them online and via mobile devices.

Two key factors are driving this retail revolution. Firstly, as commonly reported, Vietnam’s economy is booming and we’re in an era of young professionals having larger disposable incomes. Alongside this are the technological advances that not only give us the platforms to shop on but the means to access them, i.e. mobile devices.

As much as the demand for online shopping in Vietnam is increasing it can only be fuelled by providers giving consumers the platform to make choices and purchases. Currently the online market for general purchases is dominated by four companies – Lazada, Shopee, Tiki and Sendo – who have each built huge online marketplaces supported by sophisticated web technology and apps.

In 2018, these key online retailers enjoyed significant uptake of their mobile apps but this area is still dominated by the big social media companies, Facebook and Zalo. Around 80-90% of online shoppers have these two apps installed on devices, giving them immediate access to shopping at the touch or swipe of a screen.

The mobile apps for the online retailers unsurprisingly don’t come close to those percentages but, across all ages, around 40% of online shoppers have installed Lazada and Shopee apps. In the case of Shopee, over half of younger shoppers (aged 18-35) have downloaded its mobile app. With mobile devices and apps becoming such a fundamental part of our lives we have to believe that online retailers will look to these channels as a way of increasing market share in what will become an increasingly competitive arena.

Facebook is commonly used for fashion, which accounts for almost two-thirds of purchases made through the portal. With the social media giant’s omnipresent position and the ease with which independent retailers can create fan pages and online stores, it’s not surprising that younger, fashion-conscious shoppers are migrating to Facebook instead of the malls.

The online platforms are finding their niches too. Lazada relies heavily on fashion sales but nearly a quarter of their sales are for electronics, including gadgets and accessories, making them the leading marketplace in this sector.

Whilst Shopee is also strong on fashion they are the strongest marketplace when it comes to cosmetics and personal care items. However, if we want to look at an online company that has truly captured a market segment then that would be Tiki, whose books and stationery market share exceeds all other marketplaces combined.

Purchase your Vietnam online shopping report here

With online shopping still in its infancy in Vietnam, these channels have the opportunity to both strengthen their areas of specialisation as well as gain sizable growth in the smaller segments. The product lines that are maybe not eye-catching now, could well provide significant revenue streams as more Vietnamese consumers shop online.

As online retail shopping finds its feet it’s understandable that shopping platforms and online stores focus on site visits, page views and customer retention ahead of transaction value. With massive investments made in technology and marketing, winning customers – and keeping them loyal – is key.

However, longer term, online companies will undoubtedly want to see shoppers spending more on higher value items. Currently, almost a half of transactions have a value of under VND300,000 (approx. USD13.00), with less than 10% of purchases being over VND2,000,000 (approx. USD87.00). You have to think that Shopee, Tiki and others will hope that these figures are very different five years from now.

In this period of early success for ecommerce in Vietnam, it seems customers are responding to convenience and pricing more than customer service. Feedback from online shoppers shows that customer service is the one area where ecommerce providers can make significant improvements, with this perhaps something for the retailers to focus on to increase market share in what is already a very competitive arena. As with other online services, customer satisfaction is of course ultimately the key to success and should not be ignored for the sake of revenue.

With around 30% of shoppers rating their preferred channel or marketplace highly (i.e., would use again and/or recommend to others), this leaves a very large chunk of business potentially lost. Online shopping platforms have an average net promotor score of only 19 in Vietnam, this compares to 45 in the US. The dynamics and technology of online shopping in Vietnam may be hugely different from bricks and mortar shopping, but customer service and in return, loyalty is not.

This all points to no single marketplace having cracked it just yet. With companies continuing to truly understand what is still a very new market, diverse strengths and weaknesses are apparent so it will be interesting to see whether the likes of Lazada, Tiki et al continue to play to their strengths or will look to improve in weaker areas in order to build market share.

With social media and instant messaging acting as broadcasters, brand awareness of online shopping channels is extremely high, with many companies enjoying an awareness factor of around 80% amongst all online shoppers. Of course, awareness of a brand doesn’t necessarily translate into clicks and purchases. With the help of price comparison tools, plenty of consumers are jumping around sites and apps in search of deals and promotions.

Savvy Vietnamese consumers will put their purses and wallets ahead of brand loyalty; they understand the importance of comparing prices, looking for bargains and checking deals and promotions. For the consumer, online shopping means choice perhaps above all else. Give consumers choice though and they will want to know that they’re getting the best prices, the best value and the best deals. With so much information available at the touch of a screen or click of a mouse, it’s quick and easy to compare prices between products as well as brands. Online shopping allows for much easier ‘window shopping’, browsing and comparison than the traditional bricks and mortar shopping experience. With no pushy sales assistant trying to persuade the buyer, consumers have full control of their spending decisions.

Male shoppers seem to be making more considered online purchases, using price comparisons more than their female counterparts who, it would seem, tend to favour more impulsive, spur-of-the-moment shopping. A case of if they see it, they like it, they buy it.

Younger online shoppers also appear to be more compulsive, with under 25s using price comparisons less than other age groups. Are they too busy or too lazy to take time to check for the best deals? Or could it be that they’re just more in-tune with the best onlien shopping platforms and sources for deals so have less need to hunt around to save money?

The signs are that where there is a wide product selection, backed up with strong search and comparison functionality, then shoppers are happy to stay with one marketplace and not hop around looking for better prices. It’s a mantra that online marketplaces will want to borrow from the high street: once you have a customer ‘in-store’ you don’t want them to leave without making a purchase.

Another area of ecommerce where we can expect to see fundamental changes in the near future is with regards to payments. Currently, retail transactions in Vietnam are very much cash based and the vast majority of online shopping orders are fulfilled by cash at the point of delivery. However, with advances in technology we are seeing new payment methods gain in popularity. Electronic payment facilities, such as online bank transfers and e-wallets, are becoming more common and whilst they only account for a small proportion of online purchases at the moment, we see this sector increasing sharply as consumers look for increased convenience and simplicity.

Across the age groups, the range and usage of payment methods are fairly consistent. Cash on delivery is slightly more common with young shoppers in the 18-24 age bracket, as well as older shoppers aged 45-55. For the former this can perhaps be put down to young adults having less access to banking facilities, while the older shoppers are maybe more likely to hold on to more traditional ways.

When we look at the new payment methods, we can see a clear shift in the 35-44 age group who appear to be the early-adopters of the new fintech with a higher usage of bank cards, online transfers and e-wallets. The young professionals between the ages of 25-34 are also following this trend, which would be in-line with this demographic having more access to banking facilities in recent years.

Are we seeing the buyer-seller retail relationship evolve before our eyes? Most definitely. An eager audience with increasing amounts of cash to spend; technology creating new opportunities on an almost daily basis; and a burgeoning Vietnamese economy that shows no signs of slowing up, all point to online shopping surpassing street and mall shopping as the consumers’ preferred choice in Vietnam.

The only question that remains is how will Vietnam’s retailers adapt to this rapidly changing landscape. Will there be more focus on customer loyalty and delivering higher levels of service to retain the customer? Will the march of technology be the dominating factor, simplifying processes to make online shopping an even more convenient and attractive proposition? Whatever the answers, you can be sure that the ecommerce landscape in Vietnam is going to look very different very soon.

Purchase your Vietnam online shopping report here

Vietnam mother care and baby care market

Sep 17, 2025

Vietnam mother care and baby are shaped by the convergence of modern science, deep cultural

Indonesia’s economic outlook Q2 2025

Aug 19, 2025

As Indonesia approaches the end of Q3 2025, the economic outlook is being shaped significantly by

Behind household appliances: understanding consumers’ preference and purchase

Aug 05, 2025

Electronic household appliances have continued to evolve over time in line with technological

Lisa Nguyen - Vietnam Marketing Lead

Mark Ratcliff - Managing Director

The team at Cimigo are my favourite researchers in South East Asia. They’ve proved adept at tackling the most private and complex personal issues at qualitative research level, not flinching when the client endlessly chopped and changed fieldwork timing, or ramped up the workload without warning. They have recruited the most extraordinarily niche consumers without pause or complaint. Their patience with clients and their flexibility and hard work that went above and beyond what was initially asked of them on two projects relating to sexual behaviour means there is now no other research company we would choose to work with in that part of Asia. The fact they also pulled off a third project for us so well, on men’s relationship with beer and beer advertising, shows they have breadth of expertise— we still quote from the report they produced.

The team at Cimigo are my favourite researchers in South East Asia. They’ve proved adept at tackling the most private and complex personal issues at qualitative research level, not flinching when the client endlessly chopped and changed fieldwork timing, or ramped up the workload without warning. They have recruited the most extraordinarily niche consumers without pause or complaint. Their patience with clients and their flexibility and hard work that went above and beyond what was initially asked of them on two projects relating to sexual behaviour means there is now no other research company we would choose to work with in that part of Asia. The fact they also pulled off a third project for us so well, on men’s relationship with beer and beer advertising, shows they have breadth of expertise— we still quote from the report they produced.

Kevin McQuillan - Chief Marketing Officer

Sam Houston - Chief Executive Officer

Minh Thu - Consumer Market Insights Manager

Travis Mitchell - Executive Director

Malcolm Farmer - Managing Director

Hy Vu - Head of Research Department

Joe Nelson - New Zealand Consulate General

Steve Kretschmer - Executive Director

York Spencer - Global Marketing Director

Laura Baines - Programmes Snr Manager

Mai Trang - Brand Manager of Romano

Hanh Dang - Product Marketing Manager

Luan Nguyen - Market Research Team Leader

Max Lee - Project Manager

Chris Elkin - Founder

Ronald Reagan - Deputy Group Head After Sales & CS Operation

Chad Ovel - Partner

Private English Language Schools - Chief Executive Officer

Rick Reid - Creative Director

Anya Nipper - Project Coordination Director

Dr. Jean-Marcel Guillon - Chief Executive Officer

Joyce - Pricing Manager

Matt Thwaites - Commercial Director

Aashish Kapoor - Head of Marketing

Kelly Vo - Founder & Host

Thanyachat Auttanukune - Board of Management

Hamish Glendinning - Business Lead

Thuy Le - Consumer Insight Manager

Richard Willis - Director

Ha Dinh - Project Lead

Geert Heestermans - Marketing Director

Vo Thi Thuy Ha - Commercial Effectiveness

Louise Knox - Consumer Technical Insights

Aimee Shear - Senior Research Executive

Dennis Kurnia - Head of Consumer Insights

Tania Desela - Senior Product Manager

Thu Phung - CTI Manager

Linda Yeoh - CMI Manager

Cimigo’s market research team in Vietnam and Indonesia love to help you make better choices.

Cimigo provides market research solutions in Vietnam and Indonesia that will help you make better choices.

Cimigo provides a range of consumer marketing trends and market research on market sectors and consumer segments in Vietnam and Indonesia.

Cimigo provides a range of free market research reports on market sectors and consumer segments in Vietnam and Indonesia.

Please enter the information for free download.

The report will be sent to your email.

When downloading our reports, you agree to be contacted for marketing purposes.

Xin cảm ơn. Một email kèm với đường dẫn tải báo cáo đã được gửi đến bạn.

Vui lòng điền thông tin vào biểu mẫu bên dưới để tải về báo cáo miễn phí.

Báo cáo sẽ được gửi vào email bạn điền ở bên dưới.

Khi tải xuống các báo cáo của chúng tôi, bạn đồng ý được liên hệ cho mục đích tiếp thị.

Please enter the information for free download.

The report will be sent to your email.

When downloading our reports, you agree to be contacted for marketing purposes.